Apply for Cape Verdean NIF online

Obtaining a Cape Verdean Tax ID (NIF: Número de Identificação Fiscal) is essential if you’re planning to move to Cape Verde. Not only does a NIF allow you to legally operate your business under the country’s favorable tax regime, but it’s also required for nearly all legal transactions—from buying a home or car to everyday purchases like a washing machine. Ready to get started? E-Residence has you covered, ensuring you have everything needed to successfully launch your remote business in Cape Verde. Don’t miss out on the benefits of a Cape Verdean Tax ID—take the first step, and we’ll handle the rest

SIMPLY SUBMIT 2 DOCUMENTS ONLINE. GET YOUR NIF IN 24HRS!

We make NIF registration straightforward and hassle-free!

Curious about the NIF process?

Send application

Fill out a very quick online form

Upload documents

Upload all required documents

Proceed to payment

Choose your preferred payment option

Get your NIF

100% money-back guaranteed

Got questions?

We’ve got answers. Take a look at our most frequently asked questions

What is a NIF?

How long does it take to acquire a NIF?

The process of obtaining a NIF in Cape Verde generally takes anywhere from a few hours to several days. However, processing times can vary depending on the specific AT office, with some cases taking up to a month. Please note that the time-frame begins from the date of payment

Does a NIF ever expire?

No, NIF does not have an expiration date and is issued “for life”. In case you lose your NIF, you will not be simply assigned a new number, you will have to start a new process from scratch and get a brand new document.

Which authority issues NIF?

The document is issued by the ‘Autoridade Tributária e Aduaneira’ (Tax and Customs Authority) and includes all relevant tax and financial information of its holder. For non-residents, obtaining this document requires a visit to the ‘Casa do Cidadão’ and the appointment of a local tax representative.

What is this “tax representation”?

Foreigners recommended to have a local tax representative in order to file for a NIF. If you don’t need it, let us know it before your application. Our processing fee covers the registration and tax representation for 1 year. It will be renewed in a one year for €99.

Can I change a fiscal representative/address/data in my NIF?

Yes, after you get residency you can change the address in your NIF, so you won’t need a fiscal representative anymore. You can do it by yourself on the official website “portal das financas”, visit tax office.

Also, you may set up an online notification channel (email and Cape Verde phone number) and ask the tax office to withdraw a representative.

How can I make a NIF for kids?

Required documents for NIF for minors:

- scan of child’s passport

- a birth certificate translated to English or Cape Verdean with an apostille (we offer the service of translation and notarization)

- scans of both parents’ passports

- NIF certificate of at least one parent

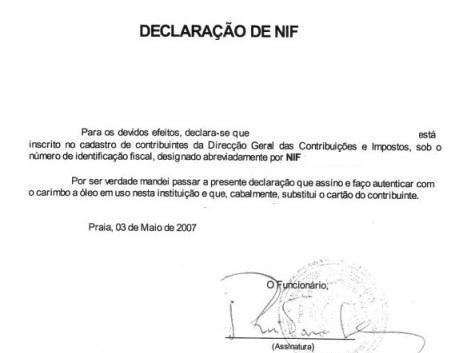

How will I receive my NIF?

In 100% cases, we send NIFs online in a PDF format. As soon as we get your document – we will send it to the email and WhatsApp you provided us.

Also, when you apply, you can add mail delivery.

Can I get a password for “portal das financas”?

Yes it is possible to request a password for this portal. In this case it will be sent to us and we will forward it to you.

Via link, you can find more info about password.

How to apply for NIF number in Cape Verde online?

For residents of Cape Verde you can apply online at Finanças (website in Cape Verdean only)

How can I check my NIF number in Cape Verde?

The NIF, or Número de Identificação Fiscal, is your nine-digit Cape Verdean taxpayer number.

You can check it in any tax office or try to log in in to your personal tax account.

Can you work in Cape Verde without a NIF?

A foreign person, resident or non-resident in Cape Verde, who works and pays taxes in Cape Verde must have a Tax Identification Number (NIF)

Do you need a Cape Verdean address for NIF?

No, a Cape Verdean address is not required. However, if you reside outside of Cabo Verde, you will need a tax representative (a service we also provide).

Do I need a NIF to buy a house in Cape Verde?

In order to buy a house in Cape Verde you will need a Tax Identification Number (NIF).

Is TIN and NIF the same in Cape Verde?

Yes, also known as a Taxpayer Number, or referred to simply by the Cape Verdean initials NIF, it is composed of nine digits and is used by the Treasury to identify people with taxpaying obligations.

Blog

Latest articles